15 February 2026

Amazon Seller Repay Charges & Refunds Explained

TweetLinkedInShareEmailPrint 8 min read By Rick Wong Updated Feb 16, 2026 TL;DR Why is Amazon charging ...

Article Contents

Success in selling on Amazon means that you will need to purchase even more products. The key issue is this: you don’t have the cash on hand when they need it. Cash flow management for Amazon sellers is vital, as is learning how to make an Amazon cash flow forecast. This lack of cash will cause major disruption to your Amazon business in the following ways:

With the scalability of the Amazon FBA business model, the issue of cash flow can arrive faster and more pronounced than other business models.

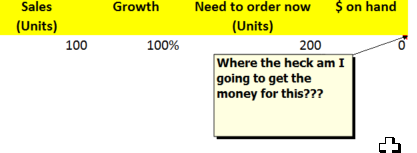

For example, if you are growing at 100% month over month on Amazon (very possible), if you have already sold 100 units, that means you need cash to purchase the next 200 units to support that growth (simple example). People will ask, “why don’t you use your saving?”, If you are doing it right, at some point, your saving will not cover the shortfall.

As an Amazon seller, you know that the Amazon A9 algorithm does not take kindly to stock-outs. You will lose your keyword ranking and sales during periods of stockouts. It is vital to have the cash to keep in stock. Therefore Amazon inventory management and cash flow go hand in hand.

The bottom line is, selling on Amazon require cash and lots of it.

Your Amazon business might be hugely profitable, but there is a timing mismatch between when your products are sold on Amazon and the time they transfer to your bank account as cash. Before going further, let define what profit is:

Profit ➡️ A financial gain, the difference between the amount earned and the amount spent in buying, operating, or producing something

So profit is what happens when it is earned, not when you get paid in cash. You can earn a profit in a transaction and not get the cash for this transaction until sometime in the future.

You cannot pay your supplier or logistics company in profits. So it is your job as an Amazon business owner to work around this issue and acknowledge that large profit does NOT mean a large cash balance. This is why creating an Amazon cash flow forecast is absolutely necessary, because it will clarify the distinction between “profits” and “cash on hand,”

A cash crunch is a situation where you don’t have the cash in hand when you need it.

For example, your supplier will need the final balance of USD 30K to ship out your order from the factory. Unfortunately, you only have USD 5K on hand, and your Amazon cash balance won’t be settled into your bank account until 7 days later. In this example, you are short USD 25K, and this is your cash crunch.

So how do you avoid this situation? You will need to forecast your cash needs in the next 30 to 60 days horizon. To create an Amazon cash flow forecast, you need to forecast cash in the following buckets:

To create this reporting, use a spreadsheet to plot the forecast dates on the Y-Axis while plotting the Cash in hand, Forecast Cash Inflow, and Forecast Cash Outflow categories on the X-Axis.

First, you will need to take into account all the cash that is available to you. It doesn’t have to be cash in your bank account. It can be assets that can be converted into cash quickly, such as stock, bonds, or time deposits. Whether you want to use these cash equivalent assets will be up to you.

For Amazon sellers, most of the cash inflow will be from the balance of the sale from your Amazon account. The trick will be to estimate the cash that will be deposited in the future. Amazon keeps a balance of your sales for 14 calendar days, so this estimate will need to be 14 days out. So the first step in creating a full Amazon cash flow forecast is to first forecast cash inflow.

There are multiple ways to estimate cash inflows for your Amazon business, some more complicated than others. To keep things as simple as possible, you can estimate the next Amazon cash inflow by average last two settlement and multiple that by a growth rate. Here’s an example, let’s say currently it is May 1, 2020, we can estimate the next Amazon payment (May 14, 2021) from the following:

The estimated cash inflow from Amazon based on the information above will be:

Est. May 14, 2021 payment = $9,790 ➡️ [($9,500+$8,300)/2] + (10% * [($9,500+$8,300)/2])

On May 14, 2021, you estimate the Amazon payment to be $9,790. This amount plus your current cash in hand balance is what you have to fund your operations (wage, supplier, shipping etc).

Cash outflow will be any payment to suppliers or any existing financial obligation. For Amazon seller, the common uses of cash are the following:

You will plot these outflow obligations on their due date in the spreadsheet. You will net this against your current cash balance forecast into the future. If any future date indicates a negative net balance, then you have a cash shortfall.

In our example, if you have to pay your supplier $7,000 on May 5th, 9 days before you get your next est. Amazon payment of $9,790. You would either 1) wait until May 14th, but this might cause stock-outs, or 2) Finance your cash shortfall.

There a few ways to plug your cash shortfall, lets list a few ways:

When your Amazon business keeps growing your personal financial resources such as your savings or your line of credit will not be enough to satisfy your cash shortfall. At this stage you might need to get external debt, that is why we do our cashflow forecast so we know when we need to reach out for external debt.

I think a lot of us grew up thinking debt is a bad thing. Debt is only bad if you are spending it one time none productive use, such as using debt to spend on a shopping spree or getting that nicer car. On the other hand, debt can be used productively to leverage your income and profits, like the saying goes “You need money to make money” and debt can do just that.

For an Amazon sellers debt can be used in 2 ways. First, debt can be used to make sure your operations will not be disrupted, which means you have the cash to pay for inventory to prevent stock out or wages to keep your business running.

Secondly, debt can “leverage up” your profit and earnings; let me explain. For example, you only have enough cash to purchase 100pcs of your product being sold for $20, your net profit margin for each unit sold is 20%. So your total net profit in this scenario is $400. But there is actually demand for 200pcs of your product, so if you use the debt to purchase the additional 100pcs, and service the debt cost your net profit will be well over the $400.

Below, is calculation of the net profit on the two scenerios:

As you can, by using debt to purchase more inventory you can leverage up your profit to $720, $320 more than if you have not taken up the debt to fund the purchase of the additional 100pcs of product.

On paper, cash flow management looks universal: money in, money out, and the timing in between. But Amazon sellers are facing unique challenges that are distinct from those that DTC operators and ecommerce businesses face.

First of all, Amazon controls when you actually receive your money. In most cases, Amazon only disburses your sales proceeds on a regular settlement schedule (often every 14 days), and may hold back funds in a reserve to cover returns, chargebacks, and other adjustments. This can introduce a substantial delay between the moment you make a sale and the point in time when you actually receive your payment.

Second, Amazon’s fee structure creates drag on cash. Referral fees, FBA fulfillment fees, inbound shipping, storage fees, long-term storage fees, and disposal or removal fees all chip away at your margins. You should be modeling these fees accurately (at SKU level) to make sure that you are actually running a profitable business, with the margins you had in mind.

Third, returns and refunds create volatility. When a customer sends a product back weeks after the initial purchase, Amazon reverses the order and may withhold funds from your next payout to cover it. If you sell products with a high return rate (such as apparel items where users may routinely shop multiple sizes just to return what doesn’t fit, or consumer electronics, you need to incorporate a certain percentage of sales in your cashflow calculations to account for these factors.

Lastly, there’s the operational reality of long lead times due to global supply chains. Most sellers are working with overseas manufacturing partners. This again hits your cashflow as it introduces a lag between the time when you pay for your inventory to when it lands in the US and gets eventually sold on Amazon. That lengthens your cash conversion cycle and increases the risk of a cash crunch if anything slips.

Most sellers look at one thing: the bank balance. If there’s money in the account, things are looking good. If the balance starts shrinking, panic sets in. The thing is: keep in mind that your band account balance is a lagging indicator. If things start going South, you might be late to course-correct and things probably will get worse before they get better.

To manage cash flow like a sophisticated Amazon operator, you need to get comfortable with a small set of simple, practical metrics that give you an early warning signal.

The first one is operating cash flow: the net cash your FBA business generates from normal operations over a given period of time. You don’t need an accounting degree to figure out how to calculate this: On a monthly basis, look at all the cash that came in (Amazon payouts, wholesale orders, other marketplaces) and subtract all the cash that went out: Inventory purchases, payroll, tools, logistics, ads, and debt service. Then track this metric over time. See if it trends up or down. Note that a growing business can show healthy revenue and profit but flat or even negative operating cash flow. So flat or negative operating cash flow does not necessarily need to alarm you as it can be a sign that you are reinvesting into your business to fuel more growth.

The second is your cash conversion cycle (CCC). At a high level, CCC measures how long cash is tied up in inventory before it returns as cash from sales. For Amazon sellers, it’s the time between:

Think of this as the equivalent of cars being built and sitting at a dealer before they get sold to a customer. The longer that cycle, the more cash is tied up in inventory. This can obviously introduce risk as product quality may deteriorate in storage, prices may change over time, or product sales may impacted by seasonality effects. If cash conversion cycle is longer than 120 days for instance, and you want to double your monthly sales, you’re committing cash for four full months of higher inventory before your bank balance reflects it. Tracking CCC forces you to ask, “Do I actually have the cash to support the growth rate I’m targeting?”

A third practical metric is payback period per SKU. When you launch a new product, how many days does it take before the cash invested in that SKU (including inventory, launch discounts, initial PPC, and creative) has been fully recovered? If your payback period is long, i.e. 180 days or so, you will likely feel strapped for cash when you try to scale. Tightening that payback window, even to 120 or 90 days, can dramatically improve your ability to reinvest in additional products.

To finance your external debt, you would probably think about reaching out to your local bank, but you will soon realize that they do not have the experience nor the processes in place to finance Amazon sellers. This means a long and cumbersome process to get your loans approved or at all. Because of this, there are new Fintech companies out there that specialize in financing Amazon sellers, and one of them being SellersFunding.

SellersFunding offers inventory loans against 50% of your inventory in FBA. That means if you have $100K in inventory, a loan of $50K can be offered. Payment to offset the loan will be deducted from your Amazon settlement until the loan balance is all paid off. Loans can be approved quickly, often in days, if you connect your Amazon seller account with their credit system.

In conclusion, Amazon seller should always be estimating their cash flow needs. It might sound cliche, but cash is literally the rocket fuel that supports the growth of your Amazon business. To avoid a cash crunch, do not be afraid to use debt and start reaching out for financing at a crucial moment when you need it.

We are SellerMetrics, our Amazon PPC Software helps Amazon sellers, brands, KDP Authors and agencies navigate Amazon Advertising PPC via bid automation, bulk manual bid changes, and analytics.

Cash flow management for Amazon sellers is the process of planning, tracking, and optimizing the timing of cash coming into and going out of your business. It includes understanding Amazon payout cycles, forecasting future cash balances, and making sure you have enough money available to pay suppliers, cover fees, fund PPC, and take advantage of growth opportunities.

On Amazon, you don’t control when your revenue is released. Payouts are delayed by settlement cycles and reserves, fees are deducted before you see the money, and returns can claw back cash you thought you had. On top of that, many sellers rely on overseas production with long lead times, which stretches the time between paying for inventory and getting paid for sales.

At minimum, revisit your cash flow forecast monthly. During high-risk or high-growth periods—like Q4, Prime events, or when launching new products—it’s smart to update it weekly. The more volatile your sales, inventory, and ad spend are, the more frequently you should refresh the forecast.

You can start with a simple Google Sheet or Excel model that lists cash inflows (Amazon payouts, other channels) and cash outflows (inventory, shipping, payroll, tools, ads, debt service) by date. More advanced sellers may integrate their accounting tools, Amazon reports, and PPC data into a dashboard, but the core logic is the same: track timing and amounts of cash movements.

Because Amazon holds your money for a period (often 14 days or more) and may keep a reserve, there is a built-in lag between making a sale and receiving the cash. That lag means you may need to pay for inventory, ads, and operating costs using cash from previous periods, not from current sales, which can tighten your cash position if you don’t plan ahead.

The key is to align your inventory planning with your cash forecast. Use your historical sales data to project demand, factor in lead times, and model when payouts will arrive. Rather than over-ordering to get the lowest unit cost, consider slightly smaller, more frequent orders that match your cash availability. Keeping a small buffer of safety stock while avoiding excessive inventory helps balance stock-out risk and cash usage.

Amazon PPC pulls cash out of your business before you see the full benefit of those sales in your bank account. If you scale your PPC spend aggressively without modeling the payback period and payout lag, you can end up with strong revenue and weak cash. Align your PPC budgets with your cash forecast and prioritize high-margin, fast-turning products when your cash position is tight.

Warning signs include: needing to delay supplier payments, cutting back on profitable ad campaigns just to preserve cash, constantly maxed-out credit cards, shrinking operating cash flow despite growing sales, and difficulty funding your next inventory order without stress. If you rely on last-minute borrowing to cover standard expenses, your cash flow management needs attention.

Yes. Profit is an accounting measure; cash flow is about timing. A business can show strong profit on paper while running out of cash because it has too much money tied up in inventory, long payout cycles, or rising costs. That’s why cash flow forecasting and active management are critical, especially on a platform like Amazon where you don’t control when funds are released.