27 January 2026

Google Ads for Amazon Amazon Products: Measurement & Optimization That Drives Real Growth

TweetLinkedInShareEmailPrint In the very competitive Amazon market of today, depending only on inte...

Amazon PPC advertising has emerged as an indispensable strategy for sellers aiming to enhance visibility, drive sales, and grow market share. However, leveraging Amazon’s rich performance data effectively can feel overwhelming without clear guidance. If you’ve ever stared at Amazon’s ad reports and felt like you were reading another language, you’re not alone.

This comprehensive guide equips US-based Amazon sellers—whether new or seasoned—with practical insights into measuring campaign success, ensuring profitability, and maintaining competitive advantage.

In the following sections, we’ll dive deep into core Amazon PPC metrics, key performance indicators (KPIs), tactical analysis techniques, and troubleshooting strategies, helping you turn raw data into actionable insights.

Article Content

Understanding fundamental metrics is critical when assessing PPC performance:

Think of these metrics as the vital signs of your campaign—if one’s off, it can throw the whole thing out of balance.

Each Amazon ad format serves distinct strategic goals, necessitating tailored KPIs:

Sponsored Products target shoppers ready to purchase. Key metrics include ACoS, CVR, CTR, CPC, and Units Sold, providing insights into ad effectiveness, cost-efficiency, and profitability. This is where you find out if your ads are actually convincing shoppers to click ‘Add to Cart’ or just scroll past.

Sponsored Brands build brand awareness and capture mid-to-upper-funnel traffic. Prioritize KPIs like CTR, New-to-Brand percentage, Brand Lift, and Video Views to gauge branding effectiveness and audience engagement.

Sponsored Display primarily retargets customers, making Impressions, Viewable Impressions, CPM (Cost per Mille), and retargeting effectiveness critical KPIs. This format optimizes visibility and conversion among previously engaged audiences.

ACoS provides insight into immediate campaign profitability, while TACoS offers strategic visibility on advertising’s impact on total business performance.

It’s a bit like looking at your diet—ACoS is your daily calorie count, while TACoS is the bigger picture of your overall health. Monitoring both ensures balanced short-term profitability and sustained long-term growth.

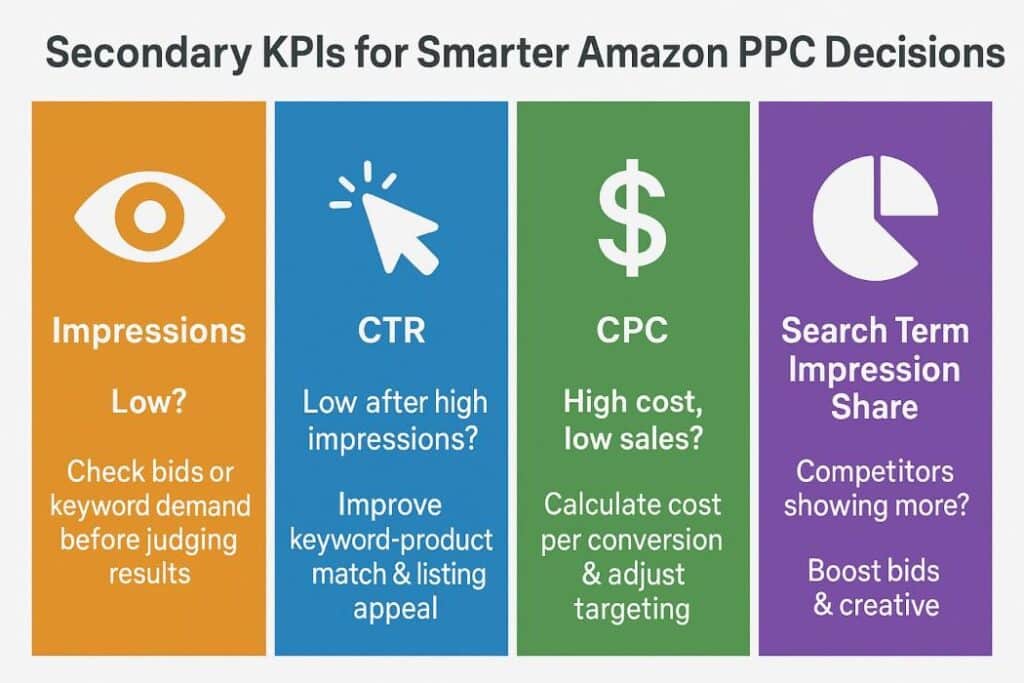

While primary KPIs like ACoS, TACoS, and ROAS provide critical insights into your Amazon PPC campaigns’ overarching success, secondary KPIs offer essential context, helping you uncover hidden opportunities and diagnose potential issues more effectively. Here are some vital secondary metrics and how you can leverage them:

Impressions reflect how often your ads appear in Amazon search results or on product detail pages. Before analyzing further, ensure you have sufficient impressions. If impression volume is too low, metrics like CTR or conversion rate lose statistical significance, making it impossible to conclude whether your keyword selection or targeting truly works.

For example, in Sponsored Products campaigns, obtaining adequate impressions at the keyword level is essential before making a final judgment about the effectiveness of specific keywords. Having no impressions is like hosting a party nobody shows up to; nothing else matters until people start walking in.

If your impressions are consistently low, examine two critical factors:

CTR measures the percentage of impressions that result in clicks, indicating your ad’s relevance to user search queries. However, evaluating CTR meaningfully requires sufficient data volume. With limited impressions and few clicks, CTR becomes less reliable. Unless your ad has garnered thousands of impressions, a low CTR might not conclusively mean your ad or keyword choice is ineffective.

If, after accumulating significant impressions, your CTR remains low, it’s essential to revisit your keyword-product alignment. Low CTR often indicates a disconnect between the user’s intent behind their search query and the relevance of your product. Refining keyword selection, improving your product’s listing title and imagery, or adjusting your ad messaging may significantly improve your CTR.

CPC directly affects your campaign’s profitability, as excessively high CPC can quickly erode margins. High CPC without conversions is like paying premium rent for a store nobody shops in.

It’s vital to evaluate CPC alongside your conversion rates to determine the economic viability of your ads. Start by calculating how many clicks, on average, it takes to achieve one sale (conversion). Then multiply this by your average CPC to determine your true cost per conversion.

If your average CPC multiplied by clicks required per sale approaches or exceeds your profit margins, your ads risk becoming economically unsustainable. In such cases, optimize your targeting to find less competitive, yet still relevant, keywords with more manageable CPCs, or improve your conversion rate through listing optimization to balance profitability.

Search Term Impression Share reveals how effectively your Sponsored Brands campaigns capture available impressions compared to your competitors. A low Search Term Impression Share means your competitors’ ads appear more frequently, potentially capturing market share that could have been yours. If your competitors are showing up more often, they’re essentially greeting your customers at the door before you do.

Monitoring this KPI helps identify competitive pressures in your niche and shows you exactly where you stand. If your impression share is too low, consider increasing bids strategically or improving your creative assets and ad copy to enhance relevancy and click appeal, thereby increasing your competitiveness in the ad auction.

By leveraging these secondary KPIs, you ensure a deeper, more nuanced understanding of your Amazon PPC campaigns, enabling smarter, more profitable advertising decisions.

Evaluating Amazon PPC campaign performance isn’t a one-size-fits-all approach, especially when comparing the goals and priorities of new sellers versus established, high-volume sellers. Understanding your business’s growth stage and setting appropriate KPIs accordingly ensures meaningful analysis and sustainable growth.

Your KPIs should grow with your business. What matters at launch might be completely different once you’re a top seller.

For new Amazon sellers, initial campaigns primarily focus on generating product awareness and establishing a foothold in the market. It’s essential to set realistic expectations. Early-stage ad spend might not yield immediate profitability. Instead, consider this period as a crucial learning phase, helping you understand what resonates with your audience and marketplace dynamics.

Key KPIs for new sellers include:

A common pitfall for new sellers is obsessing too early over ACoS or TACoS. Instead, emphasize achieving meaningful visibility, understanding market response, and gradually improving conversion efficiency.

For established sellers, particularly those in the 6-7 figure revenue range, the priority shifts from basic visibility to maximizing profitability, securing market dominance, and strategic scaling. At this stage, detailed segmentation between branded and generic search term performance becomes crucial.

While branded keyword campaigns typically deliver strong results, often making metrics like branded ACoS or TACoS less insightful, they represent a baseline rather than a growth metric. Instead, closely monitor non-branded terms to gain a genuine understanding of market competitiveness and customer acquisition efficiency. Evaluate your “Top-of-search impression share” rigorously. Losing impression share here often means competitors are actively capturing sales opportunities you might otherwise secure.

Key KPIs for established brands include:

| KPI | New Sellers (Awareness Phase) | Established Sellers (Growth & Scaling Phase) |

| Impressions | ✅ Critical for awareness | ✅ Important but more targeted |

| CTR | ✅ Vital for relevance testing | ✅ Important for refinement |

| CVR | ✅ Learning & Optimization | ✅ Essential for profitability |

| ACoS (Advertising Cost) | ✅ As learning metric | ✅ Monitor closely, optimize aggressively |

| TACoS (Total Advertising) | ⚠️ Too early to prioritize | ✅ Crucial strategic metric |

| ROAS (Return on Ad Spend) | ⚠️ Less immediate priority | ✅ High priority for profitability |

| AOV (Average Order Value) | ⚠️ Less immediate priority | ✅ Critical to maximize returns |

| Branded vs Non-Branded Sales | ⚠️ Not a key focus initially | ✅ Vital for segmenting true growth |

| Top-of-Search Impression Share | ⚠️ Not critical initially | ✅ High priority for competitive dominance |

Understanding these growth-stage-specific KPIs ensures you focus your analysis on the most meaningful metrics, helping you make informed decisions that align with your current objectives and set the stage for long-term success on Amazon.

Successful evaluation differentiates immediate, campaign-level outcomes from strategic, long-term goals.

Achieving sustainable success requires maintaining a balanced approach to short-term optimizations and long-term brand equity. Think of short-term wins as sprints and long-term goals as a marathon—you need both to win the race.

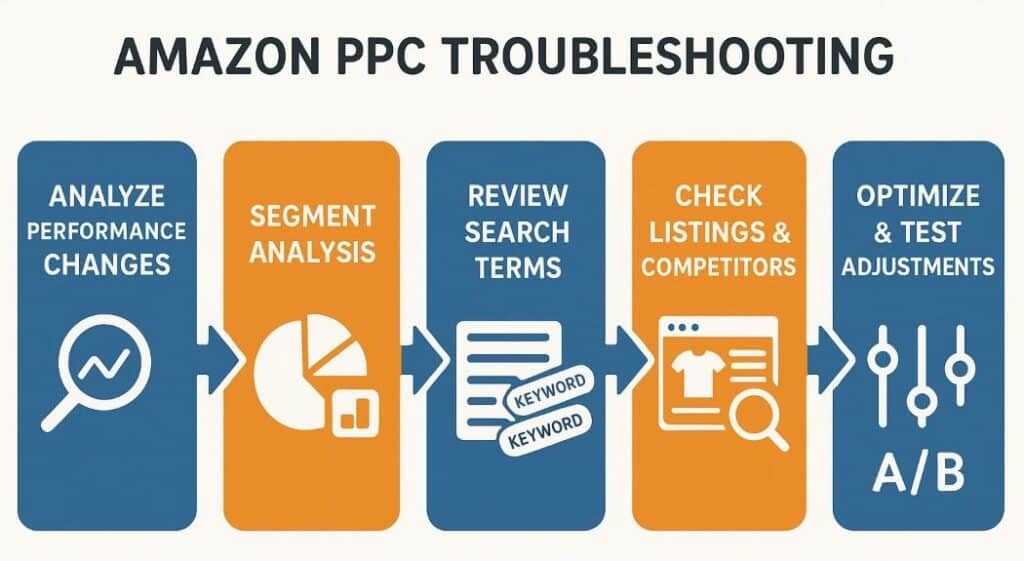

Occasionally, PPC campaigns may experience abrupt performance drops. Don’t panic—campaign dips happen. The key is figuring out if it’s a speed bump or a roadblock. Structured troubleshooting helps quickly identify and rectify issues:

A proactive, methodical troubleshooting strategy ensures swift recovery and sustained profitability.

Accurate evaluation of Amazon PPC performance involves nuanced interpretation beyond surface-level metrics. Effective sellers continuously evolve their measurement strategies, aligning KPIs with changing business goals, competitive landscapes, and product lifecycles. Regular, structured analysis empowers sellers to leverage Amazon PPC fully, maintaining market competitiveness and driving consistent growth. Always remember, data is only as useful as the action you take from it.

A good ACoS varies by industry but typically ranges between 10-30%. Lower percentages are ideal.

Your ads are profitable if your ACoS is lower than your product’s profit margin and your TACoS reflects growth in total sales. Your ads should be making you money, not just making Amazon richer.

Use ACoS for tactical campaign efficiency and TACoS for evaluating overall advertising impact on your business.

Common reasons include increased CPC, decreased CVR, listing issues, loss of Buy Box, or increased competition.

New sellers should focus on Impressions, CTR, initial CVR, and manageable ACoS.

Allow at least 2-4 weeks for sufficient data before comprehensive evaluation.

Yes, Sponsored Display often has a higher ACoS due to its retargeting nature and longer attribution windows.

Monitor CTR, CPC, Search Term Impression Share, and CVR.

Conduct weekly reviews for tactical adjustments and monthly reviews for strategic alignment.

Yes, strategic PPC can boost sales velocity and conversion rates, positively influencing organic rankings.