18 February 2026

Amazon Marketing Cloud (AMC) for Non-Enterprise: Complete Guide

TweetLinkedInShareEmailPrint 8 min read By Rick Wong Updated Feb 18, 2026 TL;DR Is AMC free and availab...

Article Contents

For Amazon sellers, Q4 isn’t just another quarter. It’s the biggest growth opportunity of the year. Between Black Friday, Cyber Monday, and holiday shopping leading into New Year’s, this period often accounts for 30–40% of annual revenue for many sellers. Put: if you don’t optimize your Amazon ad strategy in Q4, you risk leaving massive sales on the table. Think of Q4 as your Super Bowl—it’s game time for e-commerce.

Industry data underscores this opportunity. According to eMarketer, e-commerce holiday sales surpassed $260 billion in 2023, with Amazon taking the lion’s share. Year-over-year, Amazon’s Q4 sales continue to grow, and with more consumers shifting to online shopping, the trend shows no signs of slowing.

But where there’s opportunity, there’s competition. During Q4, cost-per-click (CPC) rates can spike 2–3x compared to earlier quarters, driven by brands aggressively bidding for top-of-search placements. Ad saturation means only the sellers who prepare strategically will thrive.

The persuasive reality: sellers who adapt their ad strategy to Q4 dynamics don’t just win seasonal sales. They capture long-term market share, securing higher rankings, repeat customers, and momentum that carries into the new year.

To maximize results, sellers need to understand not just the competition but also how consumer behavior shifts in Q4.

1. Shopper mindset changes. During Q4, shoppers are on a mission, not a leisurely browse. They’re looking for gifts, deals, and fast shipping. Price sensitivity decreases as urgency increases, meaning consumers are more willing to spend if the product solves their gifting or seasonal needs.

2. Device usage trends. A growing percentage of Amazon purchases occur on mobile during Q4, especially among younger shoppers. This makes mobile-optimized product pages and ad creatives essential to win conversions. Picture a gift shopper scrolling on their phone during a lunch break—that’s your window.

3. Prime membership effect. With over 200 million global Prime members, fast shipping, and Prime eligibility are non-negotiable during Q4. Prime members shop more frequently and spend more per transaction. If you’re not using FBA (Fulfillment by Amazon), you’re at a competitive disadvantage.

4. Psychology of holiday shoppers. Q4 shoppers fall into different personas:

Understanding these trends helps you time your ad campaigns and tailor messaging to meet the shopper exactly where they are in the purchase cycle.

Timing is everything in Q4. Sales don’t rise evenly—they surge in predictable waves.

Think of Q4 as a curve: slow build in October, steep spike in November, urgent surge in December, and a bonus bump in January. Smart sellers map ad budgets and strategy to this timeline instead of treating Q4 as one flat block.

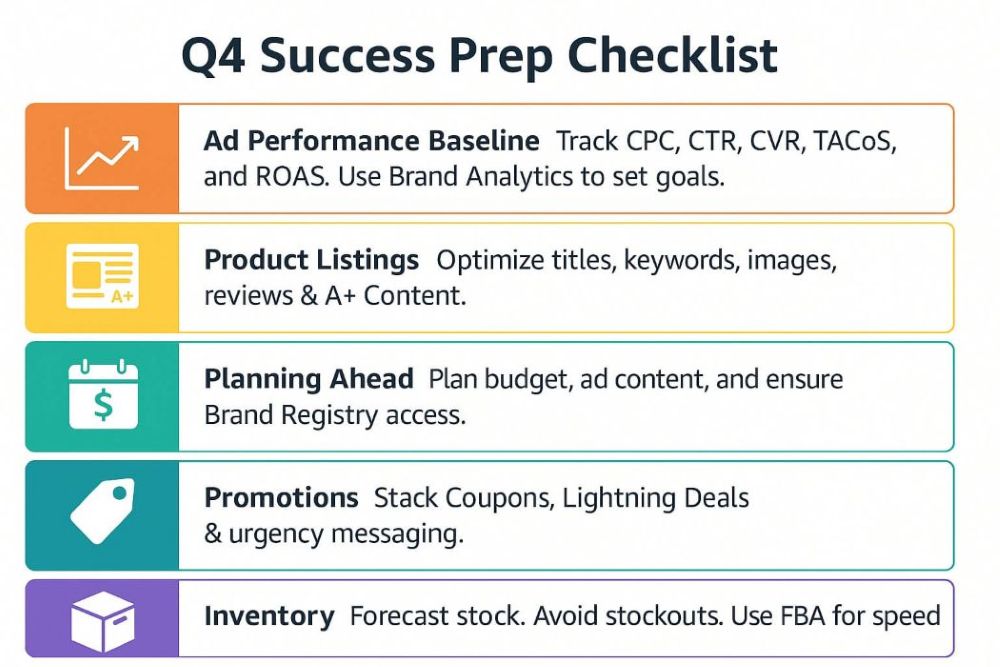

Preparation is the foundation of Q4 success. Without proper planning, even the best ad campaigns will underperform.

Before scaling in Q4, know where you stand.

This baseline gives you the data needed to set realistic goals and budget allocations for the quarter. If you don’t measure, you’re just guessing.

No ad campaign can succeed if the listing itself underdelivers. During Q4, listings should:

Remember: Ads drive traffic, but listings convert traffic into sales.

Planning early is what separates Q4 winners from the rest.

Promotions amplify ad success during Q4.

Running out of stock during Q4 is a nightmare. It not only costs you sales but also damages organic ranking and ad performance.

One of the most important decisions you’ll make in Q4 is how to allocate spend across Amazon’s ad types. Each format has a role to play, and the best-performing sellers know how to blend them into a unified strategy.

Sponsored Products remain the workhorse of Amazon advertising. These ads appear directly in shopping results and on product detail pages, making them critical for driving conversions. During Q4, Sponsored Products are essential for defending your hero ASINs and capturing high-intent traffic.

Sponsored Brands become even more valuable in the holiday season. They allow you to showcase multiple products, highlight brand messaging, and position yourself above the fold, perfect for holiday gift discovery. Video formats under Sponsored Brands tend to deliver some of the highest click-through rates during Q4, as shoppers engage with visuals faster than text.

Sponsored Display ads are a powerful retargeting tool in Q4. With so much competition, many shoppers will click but not buy right away. Sponsored Display keeps your product visible after they leave your page, nudging them back to purchase. It also gives you the ability to cross-sell or upsell to customers who buy complementary products.

The takeaway: don’t rely on just one ad type. A multi-format approach—where Sponsored Products secure conversions, Sponsored Brands build visibility, and Sponsored Display recaptures lost shoppers—will maximize your chances of success. No single ad type is a silver bullet. Think strategy, not shortcuts.

If you’re new to Q4 advertising, the first thing you’ll notice is how performance metrics shift. Cost-per-click (CPC) often rises 2–3x compared to the rest of the year, particularly in the weeks leading up to Black Friday and Cyber Monday. While this can be daunting, it’s also a sign of increased opportunity.

It’s not just about spending more—it’s about spending smarter. Click-through rates (CTR) and conversion rates (CVR) typically improve in Q4 because shoppers are in a buying mindset. This means that while you may pay more per click, the clicks are more likely to convert. The key is balancing your ACoS (Advertising Cost of Sales) with your TACoS (Total Advertising Cost of Sales). A higher ACoS may be acceptable in Q4 if it drives organic ranking improvements and boosts overall sales.

Instead of panicking over higher CPCs, sellers should evaluate Q4 ads in the context of total profitability and long-term ranking gains.

In Q4, precision beats aggression. To stay competitive, Q4 requires more than simply raising bids. You need to use Amazon’s targeting and bidding levers strategically.

One powerful lever is placement bidding. Adjusting bids for “Top of Search” placements is often worth the investment in Q4 since this is where high-intent shoppers are most likely to click and convert.

Another is dynamic bidding. Using “up and down” bidding allows Amazon to raise bids in auctions where conversion likelihood is high, which is helpful during fast-moving Q4 shopping windows. For campaigns where you want tighter cost control, “down only” may make more sense.

ASIN targeting is also invaluable. By targeting competitor listings, you can place your ads directly on high-traffic detail pages. This is especially effective for conquering market share in Q4, when many shoppers are comparing alternatives before purchasing.

Finally, consider dayparting—scheduling ads to show during peak traffic hours. For instance, if your audience tends to shop in the evenings or on weekends, concentrate spending during those times rather than running campaigns 24/7.

These advanced tactics help you make the most of your budget when every click counts.

It’s not just what people search—it’s when and why. Keywords that convert in Q4 aren’t always the same ones that work the rest of the year. Shoppers search with a gifting and deal-oriented mindset. Phrases like “gifts for dad,” “stocking stuffers,” and “holiday deals” spike in search volume.

Use tools such as Amazon Brand Analytics or keyword research platforms to identify trending seasonal terms. Supplement with Amazon’s autocomplete feature, which often reveals emerging holiday searches before competitors catch on.

The best approach is a layered keyword strategy:

By aligning your keywords with seasonal intent, you’ll capture shoppers who are actively looking to buy now, not just browsing.

Don’t wait for shoppers to find you—go where they already are. Amazon is crowded in Q4. To stand out, many sellers turn to external traffic sources such as Google Ads, Meta Ads (Facebook/Instagram), TikTok, or influencer partnerships. These channels can give you a competitive edge by reaching shoppers before they even hit Amazon’s search bar.

The benefit of external traffic isn’t just more clicks. Driving shoppers from outside Amazon can boost your organic ranking. Amazon’s algorithm rewards listings that generate strong sales velocity, regardless of where the traffic originates. This creates a flywheel effect where ads fuel visibility, which fuels organic ranking, which fuels more sales.

To measure the impact, use Amazon Attribution, which tracks how external campaigns contribute to conversions. This ensures you can double down on sources that drive profitable traffic and cut back on those that don’t.

One caution: Q4 ad costs are high everywhere, not just on Amazon. If you run external campaigns, make sure your landing product listings are fully optimized, your promotions are competitive, and your inventory can handle the extra demand. Done right, external traffic can be a game-changer for Q4 performance.

Q4 is a make-or-break quarter for Amazon sellers. With consumer demand surging, competition fierce, and CPCs rising, success depends on preparation and smart strategy. Q4 isn’t the time to wing it. It’s time to execute.

To recap, winning Q4 requires:

Those who adapt their strategies to Q4 dynamics don’t just capture seasonal sales; they position themselves for long-term success into Q1 and beyond.

And if this all feels overwhelming? That’s where partnering with an experienced Amazon advertising agency makes all the difference. With the right strategy and execution, you can outsmart competitors, maximize your budget, and finish the year stronger than ever.

Expect CPCs to rise 2–3x. Many sellers allocate at least 30–50% more budget during November and December to stay competitive.

Sponsored Products for conversions, Sponsored Brands for visibility, and Sponsored Display for retargeting are the strongest mix.

Use advanced tactics like placement bidding, dayparting, and ASIN targeting. Also track TACoS to see the full sales impact, not just ad costs.

Begin ramping in early October to build ranking before Black Friday. Sellers who start too late often overpay for visibility.

Track Amazon autocomplete and Brand Analytics. Look for gifting and deal-related terms such as “holiday gifts for kids” or “stocking stuffers.”

Yes, but don’t pull back too aggressively. December still drives high-intent traffic, especially around shipping cutoffs.

Forecast demand carefully and use FBA where possible. Running out of stock in Q4 is one of the most costly mistakes you can make.

Absolutely. Sponsored Video ads often achieve higher CTRs and lower CPCs than static formats, making them highly effective in a crowded marketplace

Yes. External traffic that converts signals to Amazon that your product is in demand, which can boost your organic ranking.